Car owners are expected to renew their car insurance policy before the expiration of the old one to ensure they continue to stay legally eligible to drive on Indian roads. However, due to ignorance, laziness or some personal emergency, Indian car owners often postpone the idea of renewing their car insurance for a few days or even weeks. While this practice is unacceptable, it is also essential to buy car insurance at the earliest.

RENEW NOW

The penalty of driving an uninsured vehicle is ₹ 2,000 for the first time defaulters and an imprisonment of three months. Repeat defaulters are liable to pay the penalty of ₹ 4000.

Here are a few essential things to keep in mind while renewing your car insurance after you have gone past the expiry date.

HOW TO RENEW?

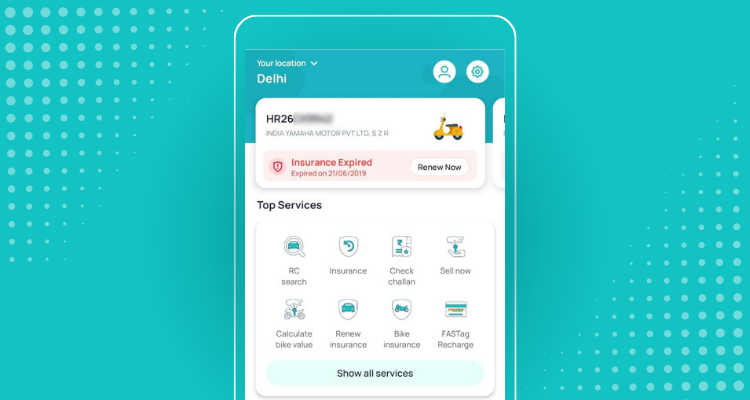

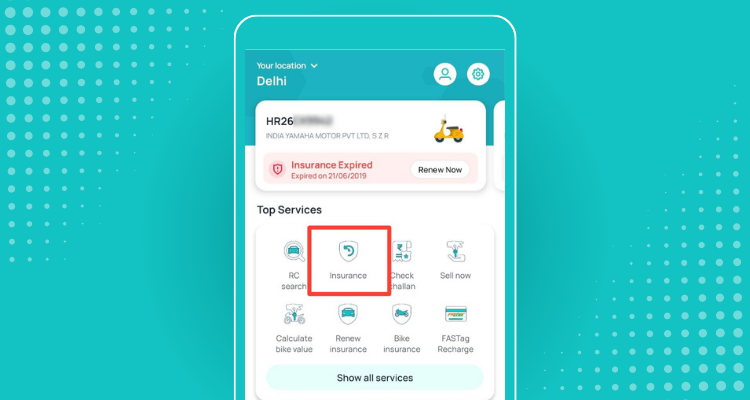

Step 1: Open CarInfo app

Step 2: Click on Renew Insurance

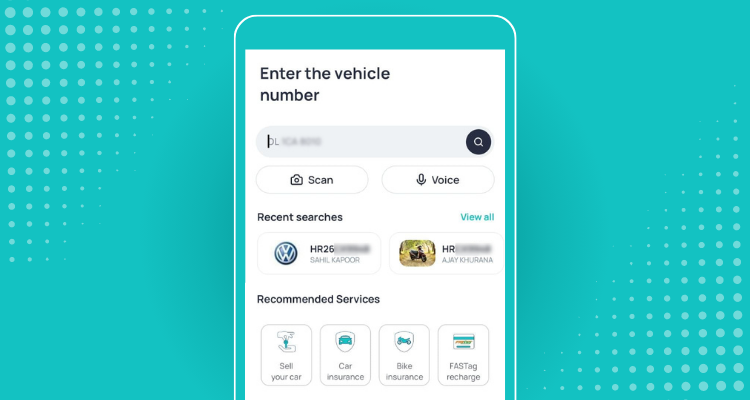

Step 3: Enter vehicle number with your mobile number

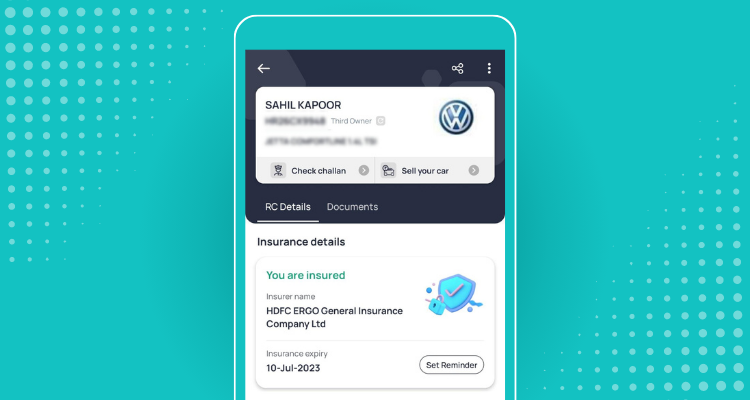

Step 4: Select your plan, either comprehensive or third party plan.

1. Renew Before 90 Days of the Expiration

Many insurance providers waive the requirement to inspect your vehicle in case you are renewing the policy within the 90 days of expiration. After 90 days, you will have to go through the elaborate process of getting your vehicle inspected physically by an agent. It might also escalate the cost of your insurance premium as it would factor wear and tear, minor scratches and dents accumulated to your vehicle over the time.

Renewing the policy within 90 days of expiration also makes you eligible to take the benefits of NCB. This means that you will not have to let go of the discount of No Claim Bonus if you renew your car insurance just before 90 days.

2. Read The Fine Print Of Your Policy

Normally, insurers tend to ignore minor dents and scratches on the car’s body while evaluating the insurance. However, ignoring minor defects will solely depend upon the discretion of the insurer based on their underwriting policy.

Keep in mind that if your vehicle has more than four minor dents then your insurance advisor might reject your car insurance policy proposal. Also, a single major dent or crack on the windshield could also reduce your prospects of securing an insurance policy.

Preexisting damages are also added in the policy you might not become eligible to ask claim for those damages. Hence, it is advisable to maintain the record of the pictures of the existing damages to avoid any confusion later.

3. Do The Renewal Online

Many insurance providers like Acko provide the facility of online evaluation of vehicle for car insurance. Online facility is more hassle-free as it attracts less scrutiny from the policy agent. Also, buying online would help you cut a better deal on the cost of your car insurance premium.